In 2025, Idaho lawmakers passed House Bill 93 — a law that sends $50 million in public taxpayer money to private schools.

Despite record-breaking public opposition, HB93 was signed into law with no oversight, no permanent cap and no guarantee that public dollars are used responsibly.

And this is just the beginning. In other states, similar programs ballooned into multi-million dollar schemes that drained public school budgets, raised local taxes, and failed to improve outcomes for students.

vouchers are not about choice, they’re about privatizing education.

Vouchers don’t add options — they just siphon resources from local schools. In other states, over 80% of voucher recipients already attended private schools

Rural schools Lose.

In Idaho, nearly half of all Idaho counties (18) do not contain a single private school. Despite this, rural tax dollars will help subsidize payouts to private institutions in Idaho’s most urban counties.

Every Idaho child deserves access to a strong neighborhood school.

Public schools are the heart of our communities. They educate 94% of Idaho students, provide community spaces, gathering places, and more.

Tax dollars with no accountability.

Unlike public schools, these programs don’t require background checks, financial reporting, or nondiscrimination protections.

HB 93 is just the beginning.

This isn’t a one-time expense. It’s the first step in a long-term plan to privatize education. Other states started with small voucher bills and within two years, Arizona’s program exploded from $65M to $332M. Idaho’s law includes no long-term limits. Once the money starts flowing, it’s hard to stop.

We can put an end to this. Join our 44 county Movement

Upcoming Town Hall Events

-

Middleton Town Hall

Wednesday, Oct 15, 2025

6:30PM to 8:00PM

Middleton Trolley Station

-

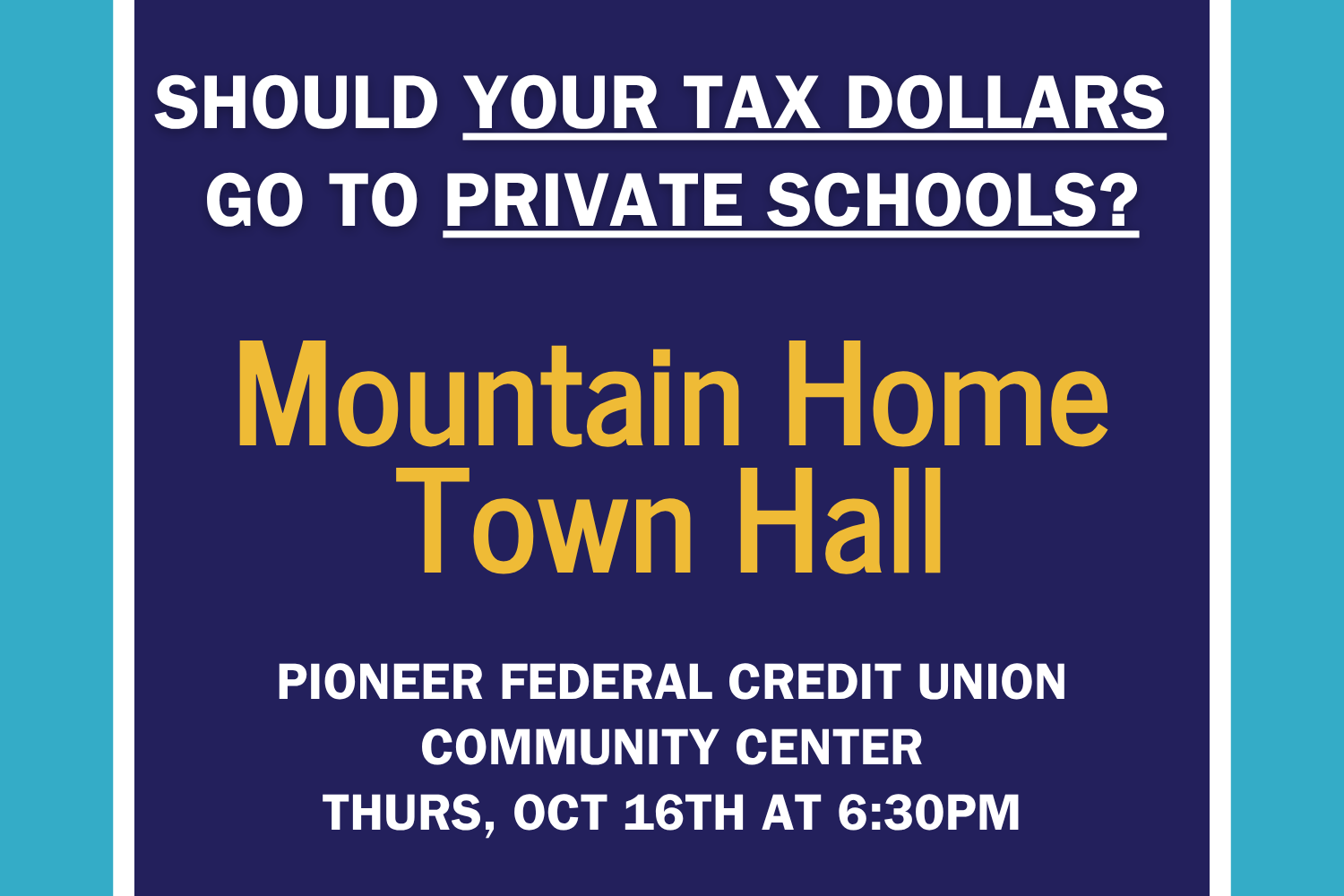

Mountain Home Town Hall

Thursday, Oct 16, 2025

6:30PM to 8:00 PMPioneer Federal Credit Union Community Center

-

Caldwell Town Hall

Saturday, Oct 18, 2025

12:00pm to 1:30pm

Vallivue Crossing -

Fruitland Town Hall

Thursday, Oct 23, 2025

6:30pm to 8:00pmFarmers Mutual Conference Center

-

Idaho city town hall

Tuesday, Oct 28,2025

6:30pm to 8:00pm

Idaho City Middle/High School